ENTREPRENEURSHIP THROUGH ACQUISITION

A Reliable Alternative To Chasing Unicorns

From the Trenches - Interview With Pennsylvanian Business Broker Bill Ilgenfritz

Q&A with business broker Bill Ilgenfritz on the current state of the business acquisition & sale industry, and where things are headed.

Bill Ilgenfritz

Current market perspective from the trenches of the business acquisition & sale industry

Sit-Down Interview With Business Broker Bill Ilgenfritz

What are your thoughts on where business acquisition & sale market activity is heading over the next 3-6 months?

Since the start of the COVID-19 outbreak and the regulations placed on businesses, various industries have been experiencing different impacts.

While supply chain issues and travel restrictions hit most businesses, some industries were not forced to shut down and were at least able to continue generating cash flow. Some even thrived. While many companies that would have been looking at M & A had to concentrate most of their focus on their own companies and spend less time seeking growth, some entrepreneurs interested in industries relating to healthcare and distribution are even more committed now to purchasing a business in those fields. And displaced corporate leaders who had to be furloughed found themselves determined to invest in their own business to be more in control of their future.

There will definitely be challenges like due diligence taking a longer period of time and negotiations having to be more creative, but there are also more incentives out there thanks to efforts to stimulate the economy and small businesses that prospective buyers can take advantage of.

Here in the Greater Pittsburgh Area, there are even a lot of new grant and loan programs for assistance from the PA Statewide Small Business Assistance Program, Urban Redevelopment Authority of Pittsburgh, and many grants aimed at female entrepreneurs to encourage small business.

I foresee many business owners with successful businesses who are close to retirement age being more committed to selling in the near future to retire and as long as sellers have realistic expectations of length of time to sell and the value of their business, I look for acquisition and sale market activity to grow.

What do you see as the most significant SELF-IMPOSED threats out there that could hurt the market for business acquisition & sale and small business activity in general?

Letting uncertainty and fear paralyze the market. If current affairs have taught us anything, it is that where there's a will there is a way. When business owners looked at their processes and started to think outside of the box and be flexible, they were able to survive and sometimes thrive even under intense pressure and limitations this year.

Buyers, sellers, and financial institutions will need to be willing to overcome the fear this year has brought and seen all the opportunity that is out there. Because even in this injured economy there is a lot of opportunities.

What do you see as the top three reasons to BUY a business in 2020?

Business owners who worked hard to keep their business thriving in this COVID economy and who are close to retirement age will be even more motivated to sell and retire. This will put some really great business opportunities on the market.

Buying an existent business that has managed to survive and generate profits even in this tough economy, and that has a customer base is a great choice for someone looking at wanting immediate cash flow and to obtain financing from an institution that will be more likely to lend to an entrepreneur when the business has a proven track record even during adversity.

There are some great incentives out there including low-interest rates on loans thanks to stimulus programs.

What are some of the questions a business owner should ask when choosing an advisor to help buy a business or work on exit planning to help navigate through this challenging stretch?

Business owners should ask advisors the following questions:

What is their track record and experience with selling businesses?

How do you value a business? 3. What do you do for your fee?

How do you find serious buyers?

How will confidentiality be maintained?

And most importantly, I tell owners to ask themselves is this advisor someone I feel I can work closely with for the next 6-12 months and someone that I can trust?

What are your thoughts on transaction terms for buyers & sellers in the current market?

Due to the uncertainty and fear surrounding businesses being mandated to shut down and/or operate at reduced capacity, I think buyers will be very focused on how to protect themselves.

Sellers and buyers will be more creative in negotiations to try to protect their interests. We may see earn-outs and contingent considerations added to negotiations on price. Especially since closing dates may be longer than usual due to the time it will take for concerned buyers to conduct detailed due diligence in the era of COVID 19.

Buyers may ask for MAC clauses (Material Adverse Change) so if there are any significant changes to the business between signing and the closing the buyer can walk away. And sellers who are willing to offer some seller financing may help alleviate buyer concerns about procuring financing through cautious financial institutions for purchase.

But there has never been a better, more acceptable time to be willing to negotiate terms…

From the Trenches - Interview With Illinois Business Broker Larry Swanson

Q&A with business broker Larry Swanson on the current state of the business acquisition & sale industry, and where things are headed.

Larry Swanson

Current market perspective from the trenches of the business acquisition & sale industry

Sit-Down Interview With Business Broker Larry Swanson

What are your thoughts on where business acquisition & sale market activity is heading over the next 3-6 months?

I believe there will be a rush to complete SBA loans before the September deadline, but after that, I feel we will see a slowdown in Buyer activity. For the remainder of 2020, many businesses will be trying to figure out what the market will be like and how it will impact them.

The start of 2021 will see a jump in new business offerings with a large group of these businesses in real trouble. These will likely not end up being sold and the number of closings will be exceptionally large.

I also see several long-term businesses that have survived the crisis coming to market in early to Mid-2021. These will be the businesses that the sellers have weathered the storm but are now tired and ready to move on. Many of these will be great opportunities for buyers to get good to great businesses at reasonable prices.

Interested to learn more about what drives business value?

What do you see as the most significant SELF-IMPOSED threats out there that could hurt the market for business acquisition & sale and small business activity in general?

The unknown direction of the market for many business segments will prevent many owners from investing in their businesses.

This will make them less attractive to buyers. The unknown future of this health crisis will cause many owners to lose confidence in their ability to survive. This will lead to more small business failures and more troubled businesses showing up in the marketplace.

What do you see as the top three things the government needs to do to support the main street business acquisition and sale opportunities for small business owners through the remainder of this year?

Main Street businesses are facing the most challenging time they have seen in years.

The government support they receive will be the difference between many surviving or closing.

The health crisis must be controlled. If a second shutdown occurs it will be devastating for many businesses.

The government’s actions to prevent another shutdown are critical. This will be a difficult effort for every level of government.

This is the most important issue the government sector must overcome. Financial support will always be needed and any other programs to extend the obligations for Main Street businesses will have an impact.

What do you see as the top three reasons to BUY a business in 2020?

Their reasons for owning a business have not changed. The main reason to buy a business is that everything is already in place for that business. This includes:

Employees and customers already in place.

An established brand.

Focus on growth and not survival.

The lower risk than starting a business from scratch.

What are some of the questions a business owner should ask when choosing an advisor to help buy a business or work on exit planning to help navigate through this challenging stretch?

Business owners should ask advisors the following questions:

What is the broker’s business experience?

Have they done exit planning for other businesses?

Have they ever owned a business?

Do they understand the financial side of a business?

Are they interested in your goals?

How would you rate the current political environment related to small business growth, business acquisition & sales?

2/5

What are your thoughts on transaction terms for buyers & sellers in the current market?

The unknowns for small businesses are impacting all sides of transactions. The risk levels are harder to define and the time for some return to normalcy is unknown.

Business owners don’t know when or to what level sales and profits will return. This works against sellers and is causing buyers to expect a discount.

Earn-outs are one of the best ways to address this uncertainty for both sides.

Seller financing is also a critical component for sales in Illinois.

Thoughts on business valuations in today's market?

Business multiples are trending lower and will continue to move lower until some stability returns to the markets. There is a heightened interest in current comps by all parties to better understand what types of deals are actually closing.

From the Trenches - Interview With California Business Broker Stewart Guthrie

Q&A with business broker Stewart Guthrie on the current state of the business acquisition & sale industry, and where things are headed.

Stewart Guthrie

Current market perspective from the trenches of the business acquisition & sale industry

Sit-Down Interview With Business Broker Stewart Guthrie

What are your thoughts on where business acquisition & sale market activity is heading over the next 3-6 months?

For businesses in the Sacramento California region, the watchwords are caution for all and exhaustion for many. "Non-Essential" businesses, (that is, those businesses that have not been granted an exception to the governor's statewide stay at home order), in Sacramento and South Placer counties have just started the process of a controlled reopening when protests and their associated curfews came about.

To be sure, many small businesses chose to ignore the closure orders or are in areas unaffected by protests, but the situation has affected the mood and buying habits of the public and significantly suppressed commercial activity, regardless of location.

The social media gallows humor we have seen during the first half of 2020 is funny, dark and a hedge against the next shoe dropping. At the same time, per Guidance Financial, baby boomers, (those born between 1946 and 1964), make up 41 percent of main street business owners, second only to generation X, (1965-1979), at 44 percent. Even before the 2020 pandemic and protests there was a lot of discussion in the exit planning/brokerage/M&A market about the pending retirement years of the boomer generation.

The oldest members of this cohort are in their mid-70's and if there was ever a good time in human history to be a septuagenarian, it's now. It is not unreasonable for them to anticipate another ten to twenty years; the question is, do they want to spend those years in their business, pushing through a recession, (again, they've done it six times since the early '80s), or do they cash out now and enjoy a long retirement? I think we are going to see the boomer owners of solid, main street businesses in the Sacramento region make a choice for the latter. And, while a well run and documented business with solid fundamentals is always attractive in any market, our region has seen dramatic real estate appreciation, (approximately 100%), over the last ten years driven by a growing population and insufficient housing starts.

As employees and mid-level managers deal with declining incomes and or layoffs as a result of the region's pandemic response and cultural disturbances, I believe we are going to see a large influx of financial buyers, funded by home equity, that want more control over their lives and are willing to, (at least initially), "buy a job", with the goal of growing into business ownership. As always, the result of more money pursuing a limited commodity will be an increase in price. It's a great time to sell a good business.

What do you see as the most significant SELF-IMPOSED threats out there that could hurt the market for business acquisition & sale and small business activity in general?

Short-term thinking, all the way around. Times are extraordinarily tight and many small business owners are having to cut expenses across the board.

My hope is that when they see their way clear to start spending again, that they have a handle on the most effective portions of their marketing budget and that they get those back up and running as soon as possible.

Marketing budgets are early and frequent casualties during business downturns. This is exactly the wrong response, but understandable if the business owner cannot correctly attribute marketing dollars to new business.

Local SBA lenders have already noted that their goal is to be able to "carve out", March, April, and May in their business analysis because of current circumstances; they plainly state that they understand that it would be unfair to analyze 2020 tax returns in 2021 without acknowledging the effect of the pandemic response.

What this means is that, as soon as possible, business owners need to grow business volume back to a level that clearly shows that, absent a government-mandated shutdown, the fundamentals of the business are sound.

Not aggressively pursuing revenue recovery through marketing and sales will have consequences on business valuation in the next few years.

What do you see as the top three things the government needs to do to support the main street business acquisition and sale opportunities for small business owners through the remainder of this year?

Lift the shutdowns as soon as reasonably possible - This is not to decry government action in general, (like all government policy, it is a blunt instrument), but a CYA, zero risk mindset will extend the shutdowns longer than what is necessary.Statute(s) to limit liability for Covid-19 infections - If a small business owner opens their doors, their clients should be cognizant of the risk they are taking by participating in the economy and can choose to or not to engage with a business in person. However, since they can choose whether or not to enter a business, they should not be allowed to hold the business liable if they contract an infection Occupational Licensing Reform - This is a reform that will have a positive effect on the California economy in general as it has, for the most part, been put in place to protect the wages of those who are already in a given profession at the expense of new entrants without really enhancing consumer safety.

What do you see as the top three reasons to BUY a business in 2020?

Sacramento's population is growing. Relative to the rest of the nation, it is an expensive market, but relative to the rest of California it is inexpensive and an attractive alternative for high-wage earners and business owners in the San Francisco Bay Area.

The pandemic has suppressed economic activity. For a well-funded and sophisticated buyer or a strategic buyer, this will likely translate to reduced list prices for businesses. Some businesses will not recover, most will. Prospective buyers will need to move quickly if they want to take advantage of the discount.

The suppressed economic activity mentioned above will undoubtedly translate into pent-up demand for goods and services as the economy opens, (and the election recedes into the rearview mirror).

Regardless of who occupies the Whitehouse in January of 2021, there will be a surge in optimism as the country puts uncertainty and negative campaign strategy behind it for a year or so until the 2022 midterms.

What are some of the questions a business owner should ask when choosing an advisor to help buy a business or work on exit planning to help navigate through this challenging stretch?

Business owners should ask advisors the following questions:

Does the advisor, (assuming the advisor is a business broker or M&A professional), support co-brokerage? While not a perfect correlation, this will typically translate into more and better qualified prospective buyers. Does the advisor have a list of professionals that a seller or prospective buyer can access to help through the business transaction?

The list should include at least, accountants/CPAs, attorneys, and financial planners but will likely include other, more specialized professionals.

If the business does not present a value that is sufficient, is the advisor equipped to provide support and direction until the business is ready to sell?

What is a business broker and what can they do for a small business owner?

How would you rate the current political environment related to small business growth, business acquisition & sales?

2/5

What are your thoughts on transaction terms for buyers & sellers in the current market?

I think that there will already be a COVID discount for buyers, this is the most significant cultural event since WWII. The real question is that buyers are incented to inflate the long-term impact of COVID while sellers are incented to minimize it.

We've already seen SBA lenders openly asserting that they will do everything they can to reasonably account for the effects of the pandemic while not unreasonably penalizing business valuations when they are likely to recover.

I think that's good guidance from smart people that have skin in the game; as a way to set criteria on who to listen to, it doesn't get any better than that.

Thoughts on business valuations in today's market?

I think that valuations are going to be heavily scrutinized by all parties involved. Sellers typically believe that their business is worth more than an industry-standard valuation as it is.

I believe that, without a clear explanation as to how the pandemic financials were dealt with in the equation, the assumption will be that the person doing the valuation penalized the business too much based on the pandemic.

The buy-side will want to emphasize the effects of the pandemic and will negotiate as if most or all the business lost in the pandemic is never coming back. The truth likely lies somewhere in between.

View the Full Interview

Watch full interview with California Business Broker Stewart Guthrie

If Private Equity Falters, So Does The General Economy

Why private equity has been unlikely winner of coronavirus pandemicInteresting CNBC Power Lunch piece covering the current relationship, for better or worse, between private equity and the general economy, and the impact a downturn in private equity is likely to have on the main street.

“30% of giant Blackstone’s money actually comes from public pension plans.”

Source: Power Lunch - CNBC

To view the Power Lunch piece in its entirety, you can do that here:

You might want to read this.

See what business brokers from around the country had to say about the coronavirus impact on the Merger and Acquisition industry. Some great advice to current small business owners who are planning to put their small business for sale.

Read more related content from our blog.

From the Trenches - Interview With California Business Broker Harry Sidhu

Q&A with business broker Harry Sidhu on the current state of the business acquisition & sale industry, and where things are headed.

Harry Sidhu

Current market perspective from the trenches of the business acquisition & sale industry

Sit-Down Interview With Business Broker Harry Sidhu

What are your thoughts on where business acquisition & sale market activity is heading over the next 3-6 months?

We are Main St. brokers in the San Francisco Bay Area. We specialize in gas stations, liquor/convenience stores, restaurant/bars, commercial real estate, and commercial/SBA financing.

Obviously, we have seen a major drop in restaurant sales. We have also seen an uptick in interest in Convenience/Liquor stores & Gas Stations.

We predict that full-service restaurants are going to continue to suffer but delivery/take-out only restaurants will continue and expand their offerings. California state has just issued re-opening guidelines for eateries. The number of customers will be restricted in dining establishments which will likely too hard for smaller restaurants to manage especially if they were already operating on thin margins. Larger and franchise restaurants may fare OK if they are able to accommodate all the additional state-mandated adjustments.

What do you see as the most significant SELF-IMPOSED threats out there that could hurt the market for business acquisition & sale and small business activity in general?

Fear coupled with uncertainty on how long this recession will last is keeping most investors from buying new businesses.

What do you see as the top three things the government needs to do to support main street business acquisition and sale opportunities for small business owners through the remainder of this year?

Another stimulus package for small businesses.

Extend paycheck protection, let business owners use the money for rent (the current PPP program only allows the use of funds towards rent not more than 25% of the total grant).

SBA should waive loan fees of approximately 2.5% of the loan amount.

What do you see as the top three reasons to BUY a business in 2020?

Only businesses with verifiable books are going to sell.

Opportunity to buy a business with positive cash flow at a reasonable price.

Take advantage of 6 months worth of free SBA loan payments & historically low-interest rates on SBA 504.

What are some of the questions a business owner should ask when choosing an advisor to help buy a business or work on exit planning to help navigate through this challenging stretch?

Business owners should ask advisors the following questions:

Are there buyers to buy a business?

Are there verifiable, clean books and records?

Is the business eligible for SBA financing (key to materialize a sale)?

How would you rate the current political environment related to small business growth, business acquisition & sales?

2/5

What are your thoughts on transaction terms for buyers & sellers in the current market?

Seller expectations are expected to be reasonable. Good businesses with clean records are eligible for SBA financing that is easily available (banks are eager to lend), hence I do not expect big price drops in the asking price but businesses with poor financials are going to face a much tougher time to sell. Call it Biz Opp Darwinism.

There's a major problem in the hospitality industry. What will survive are take-out, deliveries, commercial kitchens, and the like which are going to be the main focus going forward until we have a vaccine or herd immunity. Landlords providing significant rent concessions will make a big difference considering the inflated costs of Bay Area rents pre-COVID-19.

Thoughts on business valuations in today's market?

Valuations are based on multiples. It's too early to say but if this current situation drags on through 2021-22, valuations will eventually be highly affected.

We are pretty sure that appraisers for lenders won’t be comfortable basing valuations for hospitality businesses only on historical numbers and completely ignoring post-COVID-19 impacts to a business's financials.

From the Trenches - Interview With North Carolina Business Broker Don Emmett

Q&A with business broker Don Emmett on the current state of the business acquisition & sale industry, and where things are headed.

Don Emmett

Current market perspective from the trenches of the business acquisition & sale industry

Sit-Down Interview With Business Broker Don Emmett

What are your thoughts on where business acquisition & sale market activity is heading over the next 3-6 months?

I am seeing and I think we will continue to see, more activity, sell-side, and buy-side. pent up supply and demand for good businesses. Along with the Boomer equation (10k hitting 65 yrs old every day) In both main street and lower middle market

What do you see as the most significant SELF-IMPOSED threats out there that could hurt the market for business acquisition & sale and small business activity in general?

Did self impose, on me? Or self-imposed from a buyer or seller? I think procrastination is the main threat to all of the above

What do you see as the top three things the government needs to do to support the main street business acquisition and sale opportunities for small business owners through the remainder of this year?

Support & fund SBA

Do blanket forgiveness for PPP under $150k

May need another round of stimulus b4 this is over

What do you see as the top three reasons to BUY a business in 2020?

The boomer equation

The unpredictability of "corp" employment/career tracks

Control your destiny

What are some of the questions a business owner should ask when choosing an advisor to help buy a business or work on exit planning to help navigate through this challenging stretch?

Business owners should ask advisors the following questions:

How long have you been selling businesses?

Have you ever owned a business?

What is your closing ratio of businesses listed?

Do you co-broker?

Are you a member of IBBA/CVBBA?

What certifications have you earned?

Experience in transactions

Experience in previous careers.

References/success ratio

How would you rate the current political environment related to small business growth, business acquisition & sales?

3/5

What are your thoughts on transaction terms for buyers & sellers in the current market?

Of course, as they say, "It depends" If biz has not been affected by COVID, no discount. Some effect? May see the use of different structures such as Earn Outs Seller finance with forgiveness etc.

In the Raleigh/Durham/Chapel Hill Triangle, we are still seeing and forecasting strong growth, which likely to continue if not strengthen as companies/ employers and talent seek less dense population centers. The region is already attractive because of the lower cost of living and fairly recession-resistant economy due to the number of major Universities and prevalence of Pharma and tech.

Thoughts on business valuations in today's market?

Again, " it depends" for the most part we are using the past to predict the future the "present" may or may not have much impact.

Watch the whole interview with North Caroline Business Broker Don Emmett.

From the Trenches - Interview With Wisconsin Business Broker Steve Boylan

Q&A with business broker Steve Boylan on the current state of the business acquisition & sale industry, and where things are headed.

Steve Boylan

Current market perspective from the trenches of the business acquisition & sale industry

Sit-Down Interview With Business Broker Steve Boylan

What are your thoughts on where business acquisition & sale market activity is heading over the next 3-6 months?

I believe M&A activity will slowly pick up throughout 2020. If there is another wave of COVID-19 cases, however, there might not be a major activity increase until Q1 or Q2 of 2021.

What do you see as the most significant SELF-IMPOSED threats out there that could hurt the market for business acquisition & sale and small business activity in general?

Business owners who want or need to sell and have unrealistic expectations for the value of their business, which are often fueled by getting an inaccurate valuation from an advisor who does not sell and value businesses for a living. This is always true, but with COVID-19 affecting revenues and profits in so many industries, business owners need to realize the market dictates what the business will sell for.

What do you see as the top three things the government needs to do to support main street business acquisition and sale opportunities for small business owners through the remainder of this year?

Keep interest rates low, encourage the SBA to lengthen forgiveness periods, and be honest about how we need to manage the COVID crisis.

What do you see as the top three reasons to BUY a business in 2020?

There are still financially strong companies in the market.

Interest rates are low.

If buyers are looking for turn-around opportunities, there will be tens of thousands of businesses unable to weather their current financial losses.

What are some of the questions a business owner should ask when choosing an advisor to help buy a business or work on exit planning to help navigate through this challenging stretch?

Business owners should ask advisors the following questions:

Have you worked as a buyer agent?

What is the process you use to manage and report the results?

How would you rate the current political environment related to small business growth, business acquisition & sales?

Three out of five stars.

What are your thoughts on transaction terms for buyers & sellers in the current market?

In my conversations with multiple M&A advisors across the country and consulting with evaluation companies, we have concluded with the following 3 outcomes:

Multiples will remain unchanged.

Banks and buyers will require a higher percentage of the purchase price to be in owner financing, likely in the 10% to 15% range.

In order to give buyers and banks a sense of what the business would have done if COVID-19 had not occurred, we are taking the March-August time period for the last four fiscal years and calculating the average revenues. Then we provide that as a separate report to buyers and banks for 2020 numbers.

Thoughts on business valuations in today's market?

We work in the Midwest, and what we believe is that most industries will have a slight decrease in market value. What will change more significantly is that acceptable risk tolerance from banks and buyers will be lower due to COVID-19.

From the Trenches - Interview With Texas Business Broker Katie Milton Jordan

Q&A with business broker Katie Milton Jordan on the current state of the business acquisition & sale industry, and where things are headed.

Katie Milton Jordan

Current market perspective from the trenches of the business acquisition & sale industry

Sit-Down Interview With Business Broker Katie Milton Jordan

What are your thoughts on where business acquisition & sale market activity is heading over the next 3-6 months?

In the next 3-12 months I think we are going to see lots of good things happening in main street transactions.

Small business owners who've been contemplating when to sell are feeling more decisive about the timing. Business owners who have been considering scaling for growth now have the insight and passion they need to pivot and innovate (or cut bait, if not), and corporate refugees who have been furloughed are finally ready to take control of their destiny and invest in a small business of their own. I propose we're going to see more good stuff happening in main street markets than the doom and gloom others might be predicting.

What do you see as the most significant SELF-IMPOSED threats out there that could hurt the market for business acquisition & sale and small business activity in general?

Fear and uncertainty. But then again, I'd argue those are historically the most significant self-imposed threats we all experience in life and business. There's no such thing as a risk-free or guaranteed business investment, ever anywhere. And I think that now is the time for small business owners and small business buyers to double down on coaching, mentoring, and mindset so they can feel confident that they're evaluating circumstances without negative filters or emotions that can prevent them from taking prudent and wise action.

What do you see as the top three reasons to BUY a business in 2020?

This pandemic, for me, has underscored the importance small business plays in our lives and economies. Also, opportunities they present for freedom and increased security. Frankly, I argue that being a small business owner is the levelest playing field in the world. As to the disengaged and burnt-out corporate leaders, I say, if now isn't the best time to buy a business and become captain of your own ship, what are you waiting for?

What are some of the questions a business owner should ask when choosing an advisor to help buy a business or work on exit planning to help navigate through this challenging stretch?

How patient are you?

I say that somewhat tongue in cheek but when choosing an advisor it is important that a small business owner works with an advisor that has patience and professionalism not to act out when challenges need to be overcome, because, in my short time in the business, challenges must be overcome more frequently than the business owner realizes.

How well connected are you (to bankers, attorneys, CPAs, and other transaction experts)?

Buying or selling a small business requires a DEAL TEAM which, by definition, is more than one person. Transaction experts must have a variety of professional experts on speed dial that are highly competent, easy to work with, and professional.

What's your track record?

In many cases, buying or selling a business can be statistically unlikely. The odds of your small business crossing the finish line can be improved by working with an expert who has a proven track record and the resources necessary for success.

How would you rate the current political environment related to small business growth, business acquisition & sales?

5/5

From the Trenches - Interview With California Business Broker Andrew Rogerson

Q&A with business broker Andrew Rogerson on the current state of the business acquisition & sale industry, and where things are headed.

Andrew Rogerson

Current market perspective from the trenches of the business acquisition & sale industry

Sit-Down Interview With Business Broker Andrew Rogerson

What are your thoughts on where business acquisition & sale market activity is heading over the next 3-6 months?

The COVID-19 Pandemic is creating a patchwork of changes to small businesses.

The US Congress through the CARES Act is unleashing over $2 trillion in the stimulus. Interest rates have been cut so lenders can offer finance rates to small businesses that are the lowest we have seen in decades. The SBA through the Economic Injury Disaster Loan and the Payment Protection Program loan plus other initiatives are trying to support small business.

The market I service is in California. On March 19 2020 I successfully closed the sale of a manufacturing business and continue to see buyer interest in HVAC, computer cabling, and other businesses I have for sale.

What do you see as the most significant SELF-IMPOSED threats out there that could hurt the market for business acquisition & sale and small business activity in general?

The 'New Normal" economy is still revealing itself. California is now starting to open up but will need 3 to 4 months to see what's happening and the true impact of the COVID-19 and the Lockdown Recession we are currently navigating.

There is no question we will recover. The question is how long it will take and the new opportunities it creates.

What do you see as the top three things the government needs to do to support main street business acquisition and sale opportunities for small business owners through the remainder of this year?

The US government is doing a lot. The State of California though Go-Biz is also assisting. The California economy is exceptionally diverse with the IT sector, and the 6th largest economy alone in Southern California. Plus the Central Valley of California exports approximately 45% of its agriculture products into the other US States.

Despite its reputation, California is a positive place to do business. You just have to be willing to step through the red tape and its demands when doing business.

What do you see as the top three reasons to BUY a business in 2020?

The top three reasons to buy a California business, in my opinion, are:

The US Federal Reserve has unleashed an unprecedented amount of stimulus into the economy by dropping interest rates at their lowest level in decades.

The US Congress has added to the Federal Reserve stimulus bypassing the CARES Act, the $1200 per person household stimulus and it looks like more to come.

Business owners that were close to retiring are now more motivated to sell and move to the next chapter of their life.

What are some of the questions a business owner should ask when choosing an advisor to help buy a business or work on exit planning to help navigate through this challenging stretch?

The work I do is primarily on the selling side of businesses located in California. Therefore, I want to see accurate financial statements, a clear understanding of the seller why they wish to sell, a business that is at least steady and must have potential; even if the seller is not as motivated as they were previously. Most important though, there must be trust between both parties. There are so many challenges selling and buying a business and all parties in the transaction need to be open and honest with each other or the deal will not happen.

How would you rate the current political environment related to small business growth, business acquisition & sales?

3/5

What are your thoughts on transaction terms for buyers & sellers in the current market?

A very interesting question but I don't think can yet be answered. The economy has been locked down since mid-February 2020 and this has never been done before. Some businesses have grown because of the lockdown, some have seen little change and many specific industries such as restaurants, bars, the travel industry and more have been severely damaged. Manufacturing businesses will return to California due to its diverse labor force and the need to bring jobs back to the state.

Thoughts on business valuations in today's market?

Business valuations, in the short term, will not change very much as there are no metrics to show what is happening. As I am a business appraiser my training is to 'normalize' the performance of the business because this 'Lockdown Recession' closed the economy so quickly, unemployment spiked but programs have been put in place to try and create a V shape recovery.

We live in interesting times.

From the Trenches - Interview With Florida Business Broker Shaun Thornton

Q&A with business broker Shaun Thornton on the current state of the business acquisition & sale industry, and where things are headed.

Shaun Thornton

Current market perspective from the trenches of the business acquisition & sale industry

Sit-Down Interview With Business Broker Shaun Thornton

What are your thoughts on where business acquisition & sale market activity is heading over the next 3-6 months?

It will be more important than ever that businesses are brought to market that can truly demonstrate actual and financial performance. Businesses that are well prepared and realistically valued will sell. The decisions that the SBA and financial institutions take in the near future will shape the sale of privately held businesses for the next 2 to 3 years. Those of us who were around in 2008 well remember how difficult it was to get funding for deals in those days.

What do you see as the most significant SELF-IMPOSED threats out there that could hurt the market for business acquisition & sale and small business activity in general?

Availability of financing for deals. There are 3 players in the game, the seller, the buyer, and the bank. Without the involvement of the banks, there is only one solution, the seller has to be prepared to assist the deal by holding a Promissory Note.

What do you see as the top three things the government needs to do to support main street business acquisition and sale opportunities for small business owners through the remainder of this year?

Everything in the Orlando area revolves around tourism. As the world starts to emerge from the crisis it will be critically important for support to be given by the Government to the travel industry. Airlines, cruise lines, hotels, and theme parks will need help coming out of this or we are going to see the disappearance of major players in the travel industry. Equally, the SBA has to be ready to help the transfer of small business owners or the dreams of many sellers and buyers will be dashed.

What do you see as the top three reasons to BUY a business in 2020?

A tremendous opportunity for business buyers to take advantage of the SBA offer to pick up the first 6 months’ principal and interest payments of an SBA 7(a) loan. What a boost for buyers in that critical initial period of ownership.

After years of running a small business and experiencing several downturns, we could finally see the retirement of the baby boomers that have been predicted for so long. When that happens there will be many tremendous, well-established businesses available for sale and probably at the right price.

During the last recession, we saw executives who had lost their positions turn to private business ownership. Undoubtedly it will happen again. We had 75 million visitors in Orlando last year, it's a great place to live as well as to visit.

What are some of the questions a business owner should ask when choosing an advisor to help buy a business or work on exit planning to help navigate through this challenging stretch?

Business owners should ask advisors the following questions:

What do you do to earn your fee? Why do I need a broker? How long have you been selling businesses?

What is the current market for small business sales looking like in the Orlando area? What should I expect if I put my business on the market today?

Tell me about your experience in selling my type of business.

What about my business would attract someone to buy it? On the other hand, what do you see as a major impediment to the sale of my business? What should I do to improve my chances of sale and to improve the price that I can achieve?

How do you search for buyers? When buyers come to you what specific steps do you take to ensure that they are not going to be wasting my time?

What happens when an offer is made? If we go under contract how will we get to closing?

What other expertise will I need to help me through the sale of my business?

How would you rate the current political environment related to small business growth, business acquisition & sales?

4/5

What are your thoughts on transaction terms for buyers & sellers in the current market?

Buyers will wish to protect themselves in whatever way they can. Whether it be asking for an earn-out to be included or for a forgivable Note to be held buyers will want to see something included in the deal. If sellers think that they can get the kind of premiums that we saw beforehand then they are wrong.

We're back to the first principles. For example, in the Orlando area, the bottom has dropped out of the previously buoyant short-term rental market overnight so associated businesses such as property managers and maintenance businesses are struggling. Any that can hang through this will be seen to be a successful business.

Thoughts on business valuations in today's market?

Good businesses properly prepared and sensibly valued will sell. However, a great deal will depend upon the availability of funds from the banks backed by the SBA.

If that lending dries up as it did 12 years ago then the spotlight swings onto the seller and we have to ask them to hold a Note. If the seller is not prepared to do that then we have to question whether the business should be listed for sale.

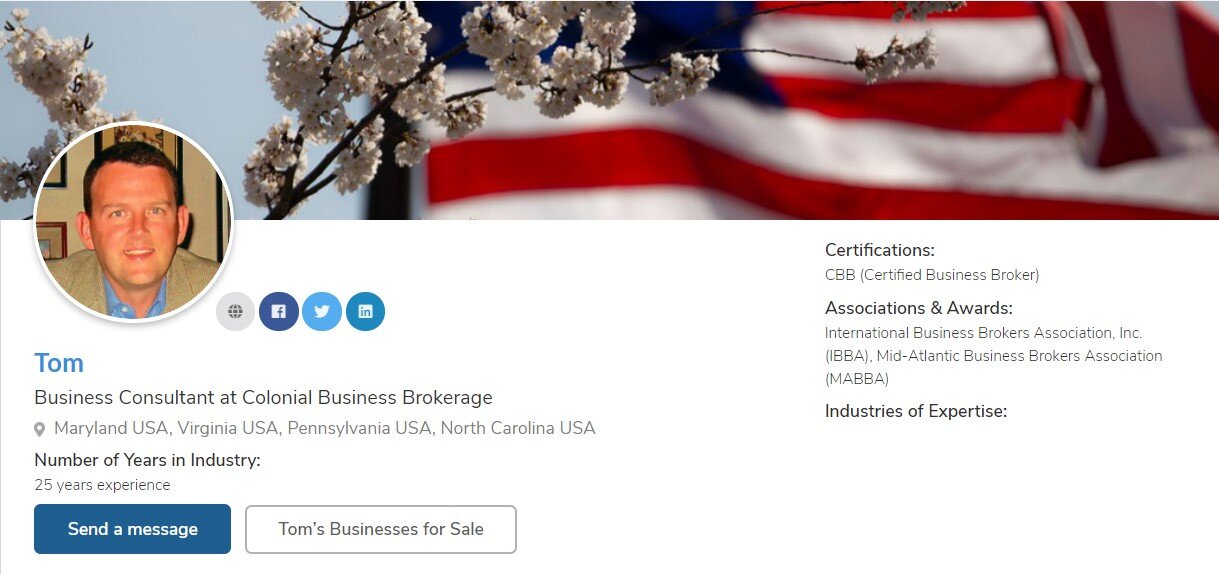

From the Trenches - Interview With Maryland Business Broker Tom Flowers

Q&A with business broker Tom Flowers on the current state of the business acquisition & sale industry, and where things are headed.

Tom Flowers

Current market perspective from the trenches of the business acquisition & sale industry

Sit-Down Interview With Business Broker Tom Flowers

What are your thoughts on where business acquisition & sale market activity is heading over the next 3-6 months?

Lower middle-market M&A has certainly come to a standstill as a result of the Coronavirus crisis. Companies that would typically be strategic buyers have been forced to focus their energy towards their own companies and away from pursuing growth and acquisition opportunities. The same goes with the private equity folks. They've been forced to spend time on their existing portfolio companies at the expense of new deal activity.

Of course, certain industries have been affected more than others; such as travel and leisure, transportation, and oil and gas. These industries may see upticks in M&A activity later this year as buyers see opportunities for bargains in these sectors. And while the existing M&A pipeline is thin, the percentage of transactions involving rescue deals, restructurings, and distressed sellers will likely increase, both in dollar terms and as a percentage of overall M&A activity.

Negotiations will take longer. Due diligence will take longer, many more issues to resolve now. Third-party consents (such as from landlords, customers, and licensors) will take longer to obtain. There will be delays in obtaining any necessary licensing, antitrust, or other regulatory approvals. M&A agreement terms will take longer to negotiate. Valuations from comparable transactions, even those entered into very recently will likely be no longer applicable. Buyers requiring financing will encounter delays. Buyers and their boards of directors are going to be much more cautious, and internal justifications for deal-making in this environment will need to be more compelling.

What do you see as the most significant SELF-IMPOSED threats out there that could hurt the market for business acquisition & sale and small business activity in general?

Due diligence. Buyers/Acquirers now have significant additional due diligence items to assess based on the effect of the COVID-19 crisis on a seller's business.

What do you see as the top three things the government needs to do to support main street business acquisition and sale opportunities for small business owners through the remainder of this year?

Open without restrictions.

Stimulate economic rebound.

Encourage small business activity.

What do you see as the top three reasons to BUY a business in 2020?

Immediate cash flow from day one.

Existing customer base and brand in place.

Financing programs available.

What are some of the questions a business owner should ask when choosing an advisor to help buy a business or work on exit planning to help navigate through this challenging stretch?

Business owners should ask advisors the following questions:

How much experience do you have selling businesses like mine?

How many like mines have you sold?

Confidentiality measures in place?

Do you have qualified buyers for my business?

How many listings do you currently have?

Do you work from home or the office?

How many businesses like mine have you sold?

How will you prevent my customers and competitors from hearing my business is for sale?

How many qualified buyers do you have?

How would you rate the current political environment related to small business growth, business acquisition & sales?

5/5

What are your thoughts on transaction terms for buyers & sellers in the current market?

What I have been seeing for businesses that will certainly be back up and running when we’re fully reopened are deals that are a little more creative. Meaning that while the business should be worth close to what it was pre-COVID-19, in order for an owner to realize that value, contingencies like earn-outs and revenue targets post-reopen are worked into the deal in order to make the Buyer feel more at ease.

Thoughts on business valuations in today's market?

COVID-19 has certainly played a role in valuation questions in today's market. For very good, well-run businesses, that will be up and running at full capacity once the nation is fully reopened, there shouldn't be too much of a hit to the valuation. Although deals for those businesses may need to be more creative in terms and structure to make the buyers feel more at ease.

From the Trenches - Interview With North Carolina Business Broker Neal Isaacs

Q&A with business broker Neal Isaacs on the current state of the business acquisition & sale industry, and where things are headed.

Neal Isaacs

Current market perspective from the trenches of the business acquisition & sale industry

Sit-Down Interview With Business Broker Neal Isaacs

What are your thoughts on where business acquisition & sale market activity is heading over the next 3-6 months?

In the Main Street and Lower M&A market, a cautious rebound is beginning. After the pandemic hit "pause" on most deals for a few weeks, a definite rebound started when local governments began to lift lockdown restrictions. Business owners are ready to get back to business, and consumer demand is pent up; and not just for products and services, but for business deals as well.

I think the transaction market will continue to build as people accept that this is the "New Norm" and transaction activity will return to pre-pandemic levels within a year.

What do you see as the most significant SELF-IMPOSED threats out there that could hurt the market for business acquisition & sale and small business activity in general?

Owners who fail to pivot will be the ones left behind. The faster owners adapt to change, the quicker they will be better positioned for the future and have more options for exit. SBA loan officers and underwriters are judging not revenue numbers, but the actions firms are taking to function in the COVID era.

Those janitorial companies who add sterilization services, those real estate firms who add virtual walk-through, those restaurants who add curbside and delivery options will be the ones to win. Those who stick with business as usual will be left behind when the acquiring parties make their choices.

What do you see as the top three things the government needs to do to support main street business acquisition and sale opportunities for small business owners through the remainder of this year?

Don't allow SBA(7) A funding to be used up by PPP loan allocations.

Enable business owners the freedom to open their businesses if they can do it safely.

Don't create scenarios where employees make more money on unemployment than going back to work.

What do you see as the top three reasons to BUY a business in 2020?

SBA Loan Forgiveness for 6 months on new loans until September.

Essential businesses are more valuable than ever.

Business owners needed to sell before COVID-19 and that demand persists under new demand from distressed business owners; the result is a buyer's market.

What are some of the questions a business owner should ask when choosing an advisor to help buy a business or work on exit planning to help navigate through this challenging stretch?

Business owners should ask advisors if they have experience selling businesses like theirs. They should ask if the size of their business "fits" into the portfolio of other businesses the broker has for sale. They should ask advisors about what ethical obligations they have when serving them; who they represent and how they are compensated. They should ask if they would work with other brokers to extend the pool of buyers, and where their buyers come from. They should ask them what steps they are taking to keep their own practice operating through the pandemic so that they are available to complete the sale with the owner. Finally, a business owner should never be afraid to ask to speak with an advisor's previous clients; owners who have exited a business successfully love to share their experiences with other owners.

What are your thoughts on transaction terms for buyers & sellers in the current market?

As we are living through unprecedented times, it's important to remember that there is no "COVID Valuation Formula." Although there are three market approaches and several complex valuation methods from the excess earnings method to the guideline market transaction method, ultimately a business will sell for what the buyer is willing to pay for it.

The beauty of entrepreneurship is that it's the owner's decision whether he or she is comfortable with the price and terms the market bears; if they don't like the market's response they have the power to improve the business and come back later for more favorable options.

There is no doubt that selling during a pandemic raises the risk for the buyer and offers that spread that risk into the future through financing options will be better received by the market.

Thoughts on business valuations in today's market?

The trailing-twelve-month Income Statement will be the key performing index as we move past the pandemic. As buyers will value based on historical earnings methods, sellers will lean more into the discounted future earnings method which takes into account fluctuating historical earnings to project what the future earnings will be.

From the Trenches - Interview With South Carolina Business Broker 'JT' Jim Tatem

Q&A with business broker ‘JT’ Jim Tatem on the current state of the business acquisition & sale industry, and where things are headed.

Jim Tatem

Current market perspective from the trenches of the business acquisition & sale industry

Sit-Down Interview With Business Broker ‘JT’ Jim Tatem

What are your thoughts on where business acquisition & sale market activity is heading over the next 3-6 months?

In the upstate of South Carolina and Asheville, Western North Carolina, we see incredible activity from both the seller and buyer sides.

Many baby boomers are looking to exit businesses they’ve built up over the last 10 to 20 years. And the next generation of entrepreneurs is in the marketplace, with money available, and no desire to work for someone else for the next 30 years of their life, to them get a watch as grandpa did. This brings both sides into a very active marketplace.

What do you see as the most significant SELF-IMPOSED threats out there that could hurt the market for business acquisition & sale and small business activity in general?

Hesitancy. People “waiting to see what happens“. Mostly back in fear and uncertainty. And it’s understandable given the environment.

We have to be the master of our own destiny, we call it “controlling the controllable”. While you can’t control everything that’s going to happen around you. You can control when you make a decision, when you take action, and when you put your effort into building something to secure your finances and your famili’s future.

What do you see as the top three things the government needs to do to support the main street business acquisition and sale opportunities for small business owners through the remainder of this year?

Local government giving business owners the ability to operate within safe parameters, and common sense. Whether it’s the governor, the local mayor, or other agencies – being supportive of the local business owners is what’s going to drive the economy forward.

Small businesses in America are at the economic heart of our country. Businesses in Asheville, Greenville, Spartanburg, and Anderson are all raring to go. To be open for business. To be serving their customers. To be a destination for the community to get what they need. They're driven by community members sharing common characteristics: entrepreneurship, pride in ownership, and serving the local community. These are the people that make our economic engine turn.

What do you see as the top three reasons to BUY a business in 2020?

So many of the buyers we are talking to today want to secure their future for their families in Greenville, and Asheville. They don’t want to run the risk of being furloughed or laid off again. They want the challenge, the excitement, the hard work, and the payoff that owning your own business can afford them.

Dictating their own quality of life. Most of them have always been willing to work hard for someone else in the past. Now they’ve decided if they’re going to work this hard in the future, they should work this hard for themselves.

What are some of the questions a business owner should ask when choosing an advisor to help buy a business or work on exit planning to help navigate through this challenging stretch?

During a recent interview with a client here in the upstate of South Carolina, the buyer wanted assistance determining what type of business would be the best fit based on their background, financials, and return on investment expectation.

Working with an advisor who can help navigate the many options and has experience helping other previous buyers do the same is key.

Do they have good connections to financing resources?

Are they familiar with the landscape of independently owned businesses and franchise opportunities?

Have they helped buyers who were acquisition-minded?

Are these buyers who are first-time buyers in the marketplace?

The majority of buyers we encounter are not seasoned at researching a business, making an offer, negotiating with landlords, getting financing lined up, and getting their business started. They want a good advisor who has experience in all those things.

How would you rate the current political environment related to small business growth, business acquisition & sales?

5/5

What are your thoughts on transaction terms for buyers & sellers in the current market?

Look at the historical figures of the business. What has it done for the past few years-month over a month, year over year? That’s a better indicator of what the future of the business will probably look like.

We have a buyer in Greenville who is now asking for March and April sales as a way to negotiate a lower price. That’s not a good indicator of the history of the 15-year business. Likely not advisable to base a purchase price on that alone. At a time when many, if not most businesses were completely closed down, this particular business is still operating at 60% capacity. That alone should say to the buyer this is a solid business that’s not going anywhere.

Many sellers are offering seller financing. 50% down. 50% over a few years depending on the purchase price. Although there are also great options available with interest late rates very low, SBA financing available on good businesses with solid performance, and good books and records.

Thoughts on business valuations in today's market?

Take a long-term perspective. Our buyers and sellers in Asheville are not looking to make a short-term investment or gain. Buying or building a business is a long-term play. There’s no question that the circumstances we just went through will have an impact on us.

Debatable how long it will take to recover completely. But recover we will. We always do. Look back over the history of our country, since 1776, haven’t we always bounced back, no matter what the odds? Think Long Term.

From the Trenches - Interview With Virginia Business Broker Nathan Hughes

Q&A with business broker Nathan Hughes on the current state of the business acquisition & sale industry, and where things are headed.

Nathan Hughes

Current market perspective from the trenches of the business acquisition & sale industry

Sit-Down Interview With Business Broker Nathan Hughes

What are your thoughts on where business acquisition & sale market activity is heading over the next 3-12 months?

I specialize in restaurants and focus on the City of Richmond and surrounding counties in Virginia. The restaurant brokerage sector over the next 3-12 months is going to see a whirlwind of activity.

Restaurant owners have seen a fundamental shift in their industry and no one can be sure where it will land at this point. All that can be assured is that models need to shift along with the new realities. Many won't want to change, and many won't be able to adapt enough.

Others will change or find that their concepts are particularly well-suited to the new world. Even without changes directly related to COVID-19, I have seen some successful multi-unit operators deciding to sell off parts of their portfolios to change how their business is set up geographically or how their individual concepts work together.

What do you see as the top three things the government needs to do to support main street business acquisition and sale opportunities for small business owners through the remainder of this year?

Clarify how the forgiveness on the PPP program works for businesses that want to sell. Reassure sellers that the intent to sell affects their chances of loan forgiveness.

Provide clear and cohesive guidance/updates about COVID-19, rather than issuing contradictory statements across different branches and different levels of government. There is a lot that can't be known about how this will play out, but don't make wild guesses just to be able to sound like you know more than you do.

Provide proper funding and personnel for the SBA, to be sure that small business lending remains reliable.

How would you rate the current political environment related to small business growth, business acquisition & sales?

3/5

Search Fund Model Diversifies Away From MBA

The search fund model presents an amazing opportunity for the motivated entrepreneur, but it can also be a sort of acquisition gateway drug for newly aspiring ETA enthusiasts, ultimately leading into other forms of acquisition entrepreneurship, -like tapping the SBA for up to $5 million acquisition loan, and negotiating focus on seller financing and earnouts, particularly in this new environment.

The Search Fund Model

-Very interesting article recently on Entrepreneur highlighting recent private equity trends and the increasing appetites of family offices for the traditional search fund model. Towards the end of the article, Atta Tarki begins to address an issue that I wish he went more deeply into (hopefully your next article Atta?): The fact that more entrepreneurs who don’t fit the traditional mold of the recently graduated MBA with investment banking or private equity experience are getting into the search fund game.

In the early 2000s, 50 percent of searchers would start their search within a year of graduating from an MBA program, but that number now has dropped down to 25 percent. At the time it was also incredibly rare for searchers to not have gone to business school at all, but 19 percent of searchers now ….. start a search without getting an MBA.

What is Search Fund?

When I first engaged with the search fund model back in 2007, it was still a relatively unknown, inaccessible model. The idea of backing an inexperienced, newly minted MBA to identify, acquire and run one company was insane to most investors outside of a small group of tightly knit investors known as the “search fund mafia.” For the entrepreneur, being limited to such a small pool of tightly knit investors put the aspiring searchers at a very clear disadvantage when it came to negotiating terms, or simply having enough capital out there to back this type of investment for a growing community of aspiring ETA entrepreneurs.

Why Entrepreneurship Through Acquisition?

Family offices, and the explosion of interest in entrepreneurship through acquisition over the past decade, have changed everything, and it’s great to see the pool of investors getting deeper with each passing year as more investors become familiar with the model (and with the returns typically associated with the search fund model).

Something to note here: -One grievance I still have with the general discourse out there when it comes to the discussion of this specific ETA model is that everybody loves to rave about the great returns on investment, but the data referenced is typically for the investors, -not the entrepreneur. I’m not trying to say the search fund model isn’t a great model for the entrepreneur as well as the investor, -it is. But to hit it big as an entrepreneur with the way the search fund investment is typically structured, the search funder more often than not really has to knock it out of the park with the traditional time + performance-based equity model and liquidation rights associated with search fund investments.

For me personally, I ultimately wound up pivoting mid-search away from the typical search fund target in lieu of less proven opportunities and eventually acquired a larger piece of equity in a smaller deal that had had some clear P&L mismanagement leading up to my acquisition. Seven years later, with the help of my investors, we got that company to a point where it was ready for a viable exit.

Final Take on The Search Fund Model

The search fund model presents an amazing opportunity for the motivated entrepreneur, but it can also be a sort of acquisition gateway drug for newly aspiring ETA enthusiasts, ultimately leading to other forms of acquisition entrepreneurship, -like tapping the SBA for up an acquisition loan up to $5 million to buy a small business on your own, and focusing negotiations on seller financing and earnouts, particularly in this new environment. search fund investments

Hand picket for you - read on…

BizNexus -Learn More From Our YouTube Playlist:

BUSINESS ACQUISITION

Have you checked out our podcast?

THE BIZNEXUS ROUNDUP

Quick & dirty interviews, war stories & tips from the trenches of business acquisition, growth & sale. We aim for value, efficiency & fun, so you'll walk away with something useful to take with you along the journey of buying, growing & selling a business.

From the Trenches - Interview With Texas Business Broker Bob Fariss

Q&A with business broker Bob Fariss on the current state of the business acquisition & sale industry, and where things are headed.

Bob Fariss

Current market perspective from the trenches of the business acquisition & sale industry

Sit-Down Interview With Business Broker Bob Fariss

What are your thoughts on where business acquisition & sale market activity is heading over the next 3-6 months?

Sellers are starting to identify under-utilized assets are considering liquidating them. Perhaps it's an entire business; or maybe just a part of it. Some entrepreneurs have several investments and are thinking it would be good to jettison a low performer. Master franchise owners may have areas they really don't have time to properly service and are looking at reducing. This is a good time to focus.

Business opportunities in today's market may have historic value, but buyers are purchasing future value. Because of the future uncertainty, many sellers believe they just have to wait to liquidate. However, Seller's can either discount the present value of future cash flows for today's risk of uncertainty or offer terms that place the final value and payments into the future where they have been actually realized. There are options.

What do you see as the most significant SELF-IMPOSED threats out there that could hurt the market for business acquisition & sale and small business activity in general?

Dealing with uncertainty by doing nothing. These are times to focus on what works, not dwell on not working.

What do you see as the top three things the government needs to do to support main street business acquisition and sale opportunities for small business owners through the remainder of this year?

Address future liability issues that may trap business owners.

Develop ways to communicate safe ways to live and work.

Continue to invest in job development through the SBA and similar programs.

What do you see as the top three reasons to BUY a business in 2020?

Funding has never been this available

Positioning for a new future normal.

Becoming more essential.

What are some of the questions a business owner should ask when choosing an advisor to help buy a business or work on exit planning to help navigate through this challenging stretch?

How are you addressing the current market uncertainty?

What value can your exit planning have today?

How would you rate the current political environment related to small business growth, business acquisition & sales?

3/5

What are your thoughts on transaction terms for buyers & sellers in the current market?

Terms must address the risk that future customers will not act like past customers. That can be addressed by discounting future cash flows, having terms based on actual future performance, or offering a "mentoring" sale where the seller retains some equity and mentors the buyer the grow the business before selling the remainder.

Thoughts on business valuations in today's market?

Different approaches to valuation will produce greater variances than ever before. Of all the approaches, market comps (industry multiples) will be the most suspect.

Bloomberg Interview with Sam Zell on Market Valuations & Post-Virus Economy

Sam Zell’s take on where we are currently in terms of investment & acquisition opportunities as of the beginning of May, 2020. Basically, buyers are looking for discounts and sellers haven’t let go of the pricing expectations that existed just a couple months ago. Until those expectations move closer together, and until the uncertainty clears up, we’re in “wait and see” mode. See the full interview here:

Sam Zell On Market Valuations

Sam Zell’s take on where we are currently in terms of investment & acquisition opportunities as of the beginning of May 2020. Basically, buyers are looking for discounts and sellers haven’t let go of the pricing expectations that existed just a couple of months ago. Until those expectations move closer together, and until the uncertainty clears up, we’re in “wait and see” mode.

See the full interview here:

Hand picket for you - read on…

BizNexus -Learn More From Our YouTube Playlist:

BUSINESS ACQUISITION

Have you checked out our podcast?

THE BIZNEXUS ROUNDUP

Quick & dirty interviews, war stories & tips from the trenches of business acquisition, growth & sale. We aim for value, efficiency & fun, so you'll walk away with something useful to take with you along the journey of buying, growing & selling a business.

Petition to Save the SBA 7(a) Loan Program

The Payroll Protection Program (PPP), although necessary, as written in the bill, is depleting all available monies allocated for the standard SBA 7(a) loan program. This is causing a situation in which the program will soon run out of funds, with no further SBA 7(a) loans available through June 30, 2020.

Save Small Businesses & SBA 7(a) Loans

The U.S. Economy depends to a great extent on our small business community. The welfare of small businesses affects each and everyone of us directly or indirectly as this makes up 50% of our GDP.

The Payroll Protection Program (PPP), although necessary, as written in the bill, is depleting all available monies allocated for the standard SBA 7(a) loan program. This is causing a situation in which the program will soon run out of funds, with no further SBA 7(a) loans available through June 30, 2020.

Without the SBA 7(a) loan program, new business opportunities, expansion, and acquisitions could be greatly affected. If it is true, as many believe, that small businesses will lead us into an economic recovery, the absence of these loans could hamper the U.S.’s ability to have a rapid financial recovery and could potentially cause many small businesses to close their doors for good. We are petitioning for the reallocation of the source of the PPP funds in order to protect the resources originally intended to help all small business owners through the end of the government’s fiscal year, September 30, 2020.

In 2010, the SBA recognized the importance of small businesses by passing a recovery act allowing SBA lenders to receive a 90% guarantee on loans funded during the recovery period, while waiving all borrower fees. The resulting credit enhancement gave lenders incentive to provide small businesses with financing that they typically would not have entertained during an economic downturn. In addition, the waiving of borrower fees made it much more affordable for business owners. This provided many new jobs and stimulated the markets, shortening U.S. recovery time. This petition urges Congress to initiate and pass a new recovery act that includes the 90% SBA guarantee for loans made by lenders for at least through the end of 2020 as well as a waiver of the SBA guarantee fees for at least the same period.

-James Parker - Boss Group InternationalBoss Group International

BizNexus -Learn More From Our YouTube Playlist:

BUSINESS ACQUISITION

Have you checked out our podcast?

THE BIZNEXUS ROUNDUP

Quick & dirty interviews, war stories & tips from the trenches of business acquisition, growth & sale. We aim for value, efficiency & fun, so you'll walk away with something useful to take with you along the journey of buying, growing & selling a business.

Think Like A Sky Jumper, Merger And Acquisition Advice By John Weber

Those of us in the Mergers & Acquisition industry are trained to stay abreast of breaking news affecting the economy.

A Contributing Blog Post By

John B. Weber, Vice President, Water Street Advisors, LLC. a boutique Merger and Acquisition firm serving businesses in the Midwest.

Those of us in the Mergers & Acquisition industry are trained to stay abreast of breaking news affecting the economy.

Merger and Acquisition Industry

Here is what John has to say about exiting your business: “If you want to sell your business but have been waiting for the perfect time when things rebound it may be a very good time to revisit a sale. Consider that buyers will be more willing to accept explainable poor performance during this time especially if the business bounces back quickly when the economy picks up again.”

John went further and stated in his recent post, Think Like A Sky Jumper, that this is a great time to make sure that your corporate records are correct, that you have a succession plan in place, that you have a funded buy-sell agreement, and that you have talked through your plans with your family.

With permission to re-post, we’re bringing you the full article to read through..

During this time, we start by first extending our hopes that you and your family, employees, associates, and friends have remained healthy, safe, and secure during this most tumultuous time.

We also hope that you have adapted to working from home. Some, like myself and my partners at Water Street Advisors do this every day. Whether you are a veteran at it or just finding your way, the change of pace offers a time of catching up, prioritizing, and contemplation. Those of us in the Mergers & Acquisition industry are trained to stay abreast of breaking news affecting the economy. The last few weeks have been a veritable sea swell of information from well-meaning experts offering amazing opportunities for learning and enrichment to chart a course through this crisis. We have seen the assistance of leaders from all branches of Government, who refreshingly have come together to try to offer solutions.

Economy and the new normal

Whether you believe that this will be a “U” or “V” shaped downturn in the economy, at some point we must start focusing on getting back to normal, whatever the ‘new’ normal will be. I have never snow skied, so I have no idea what it would be like to perform a ski jump. But, I have jumped some things (on either a bike or a sled when I was a much more flexible kid), and there is a point that you can sense when to push downward against gravity just before you are about to become airborne. Thinking positively, perhaps we can successfully launch once we sense we are near being airborne again.

Some things to consider:

• If you are in the process of accessing the funding made available under the CARES Act, or if you are in the process of selling your business, it will be important during this time to keep detailed records of expenses incurred and revenues not realized as a result of the Covid-19 virus actions. This information will be important to have to document the reasons/uses for the loan proceeds, and reasons why this was a complete anomaly in your business.